While health insurance has dominated the headlines lately due to constant political turmoil surrounding it, actual useful information for consumers can be hard to come by. Open Enrollment starts in one week, but since advertising and outreach was slashed by 90%, individuals may not be fully educated on additional issues with buying health insurance this year:

- Sign-up time is limited to just 45 days, from Nov. 1 - Dec. 15. That’s half the time of last year’s Open Enrollment.

- Despite relentless rhetoric concerning individual tax credits and cost-sharing reduction payments (CSRs) to health insurance carriers, qualified persons will still receive subsidies to help lower their deductibles and copays.

- Choices in many parts of the country will be limited to just one health insurance carrier on exchange. Some carriers have moved out of certain markets, so your current carrier may not even be available this year.

While rate increases will vary by market, overall, individuals should be prepared for their rates to rise significantly. The national average rate increases for plans across the country is around 34%, mostly due to President Trump’s decision to stop CSR payments to carriers. (If he hadn’t issued his order to stop those payments, projected increases were due to average around 7.6%.)

Shoppers should also keep in mind that on-exchange plans are still guaranteed issue, which means they cannot be turned down or charged more for pre-existing conditions, and the individual mandate is still in place, meaning persons who go without insurance in 2018 will pay a penalty.

And while there’s been conflicting reports among the public on whether those penalties will be enforced, the IRS announced last week they will be taking steps to enforce that mandate. In fact, for the first time, the IRS will reject electronic tax returns without information regarding health coverage. (Paper tax returns could be suspended and delay any refunds.) Families could face an up to $2,085 penalty, and individuals could pay as much as $695 in penalty.

As always, it’s important to research all the details of your health insurance. While the lowest cost Bronze plan may seem even more attractive this year, deductibles will most likely be much higher. Plan networks and providers constantly change, so you should make sure your doctor is in network.

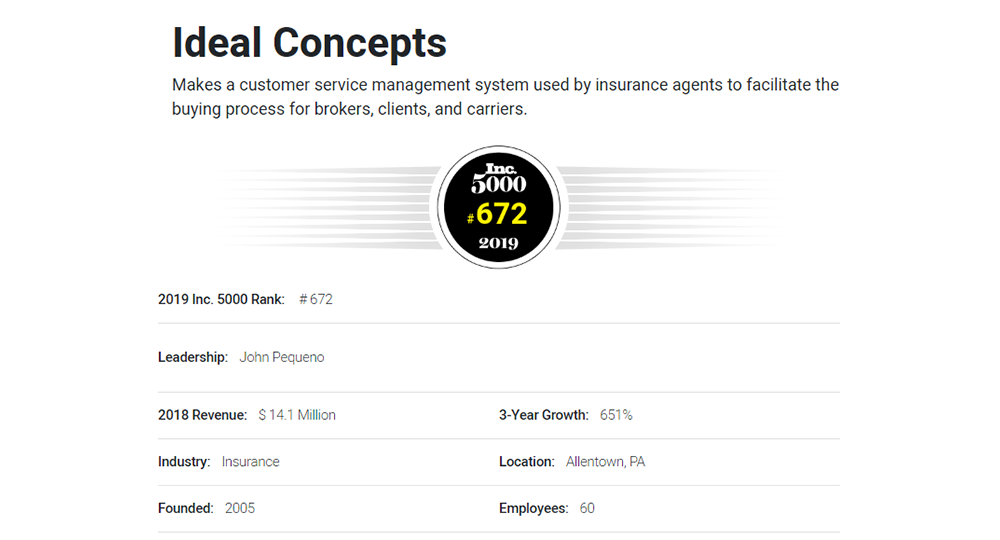

It’s always helpful to consult with one of our agency partner’s licensed insurance agents to make sure you’re making the most prudent choice for your family based on your health needs and budget. Our agency partner has been a leader in the individual health insurance industry for more than a decade.

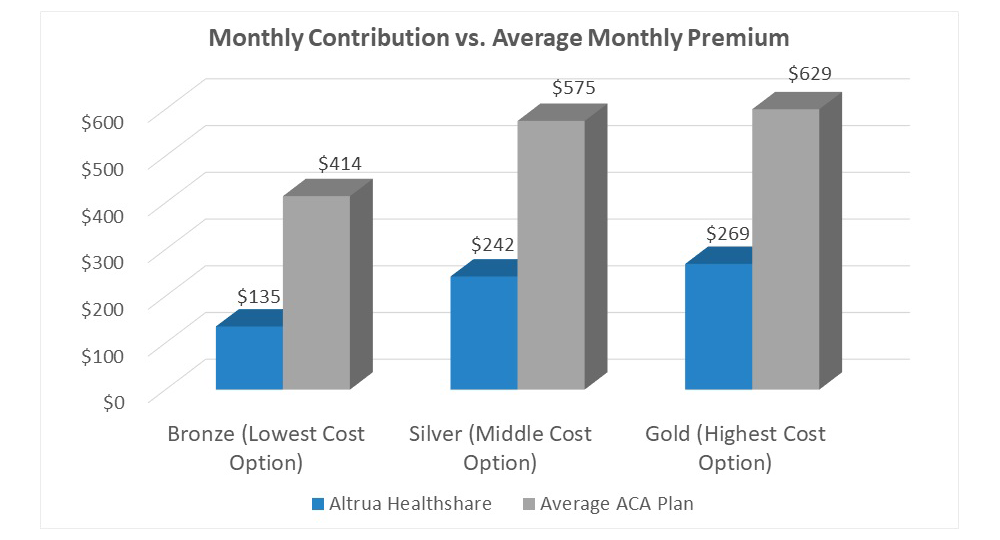

Our agency partner’s experienced, licensed brokers can cover all of your options with you, including any ACA alternative plans like Short Term health and Hospital Indemnity plans. In addition, our agency partner’s brokers can offer you supplemental plans that help cover holes in ACA coverage, like dental, vision, accident, and critical illness insurance. Pairing a Bronze level plan that has reduced benefits with a supplemental plan could be a more budget-friendly alternative to an expensive Gold level plan with a small deductible.

Call today to schedule an appointment with a broker in your area for after the start of Open Enrollment on Nov. 1st: 866.WWW.iWEB (866.999.4932). You can also shop for plans and enroll yourself on our private health exchange, www.iWebQuotes.com!